Key Takeaways

- Small, repeatable financial habits reduce stress and lead to long-term financial stability.

- Track three key metrics to stay accountable: savings rate, emergency coverage, and debt-to-income ratio.

- Utilize credible, evidence-based resources to maintain consistent and grounded learning.

Table of Contents

- Why Simple, Repeatable Money Habits Beat One-Off “Financial Hacks”

- Habit 1: Intentional Budgeting That Protects Choices

- Habit 2: Building an Emergency-Fund Scaffold

- Habit 3: Credit Hygiene Made Simple

- How to Measure Progress: The Three Metrics Every Adult Should Track

- Using Trusted Tools and Resources for Ongoing Learning

- Conclusion

Financial confidence isn’t reserved for experts or wealthy investors — it’s built through small, repeatable actions that anyone can master. In today’s fast-paced world, the challenge isn’t access to information but knowing which habits actually make a difference. For practical tutorials, relatable guidance, and clear step-by-step lessons, check out Dow Janes Reviews for empowering content designed to help everyday adults strengthen their financial literacy and achieve more control over their money.

Why Simple, Repeatable Money Habits Beat One-Off “Financial Hacks”

People are often drawn to financial “hacks” promising overnight results — but most of these trends fail because they overlook human behavior. According to data from behavioral finance studies, individuals who build wealth over time do so not through luck or shortcuts, but through consistent, low-effort habits that align with their values. Dow Janes emphasizes this principle in many of their educational videos, showing that simplicity and structure consistently outperform quick, risky maneuvers.

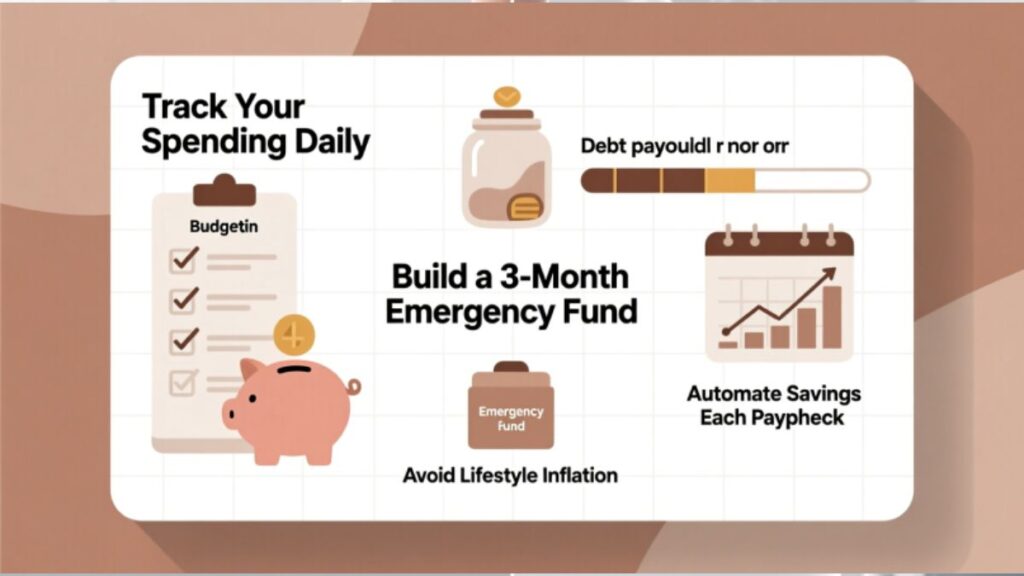

When you replace one-time hacks with systems, such as automatic savings transfers or fixed bill payment dates, you build momentum. The goal is to reduce the number of financial decisions you have to make every week, freeing mental energy for things that matter most. Dow Janes repeatedly demonstrates how even small, sustainable shifts — such as tracking spending categories or aligning pay cycles with savings goals — can dramatically increase long-term financial security. By focusing on the process rather than the hype, you can eliminate financial anxiety and gain confidence in your daily money management.

Habit 1: Intentional Budgeting That Protects Choices

Intentional budgeting is the foundation of personal finance success. Unlike restrictive budgets that feel like punishment, intentional budgeting empowers you to decide how your money serves your goals. Dow Janes promotes a method that blends purpose-driven budgeting with flexibility, ensuring that you can enjoy life today while preparing for tomorrow. The strategy starts by identifying non-negotiable expenses, separating essentials from lifestyle choices, and assigning every peso or dollar a clear purpose.

To put this into action, start by listing your monthly income and fixed costs, such as rent, utilities, and loan payments. Next, define your savings goals — emergency funds, investments, or travel — and automate contributions immediately after payday. Automation eliminates the temptation to spend impulsively. Dow Janes often stresses that paying yourself first is not just a financial tactic; it’s a mindset shift that turns saving into a built-in habit rather than a chore.

Practical budgeting checklist:

- Calculate your total monthly income.

- Identify fixed expenses and prioritize them.

- Allocate a set percentage for savings and debt repayment.

- Use a trusted budgeting app or spreadsheet for transparency.

- Review your plan periodically and make adjustments as needed.

An intentional budget gives you control over your financial narrative. As Dow Janes highlights in their tutorials, budgeting isn’t about deprivation — it’s about clarity, empowerment, and freedom of choice.

Habit 2: Building an Emergency-Fund Scaffold

Life is unpredictable — and without a safety net, financial stress can quickly spiral out of control. Dow Janes encourages building what they call a “financial buffer” — an emergency fund that grows step by step, serving as your first line of defense against unexpected costs. Many adults mistakenly think they need a full six-month cushion immediately, which often leads to discouragement. Instead, focus on building your fund like a scaffold: one level at a time.

Start small with a goal of ₱5,000 or $500, then gradually expand to cover one month of living expenses, then three, and finally six. Each milestone builds resilience and confidence. Dow Janes frequently shows that even small contributions — ₱200 or $10 a week — add up significantly over time when automated. This approach transforms saving from an overwhelming task into a simple routine built into your financial system.

To get started:

- Open a dedicated savings account for emergencies only.

- Set up automatic transfers that match your pay schedule.

- Contribute extra income — like bonuses or side earnings — to accelerate growth.

According to data from the Federal Reserve, 37% of adults in the U.S. would struggle to cover an unexpected $400 expense. Having an emergency fund prevents you from becoming part of that statistic. As Dow Janes teaches, the true power of this habit lies not in the amount saved but in the discipline it represents.

Habit 3: Credit Hygiene Made Simple

Credit hygiene is about maintaining a healthy credit profile through consistent, responsible actions. Dow Janes breaks this concept down into three simple rules: pay bills on time, keep balances low, and avoid unnecessary new accounts. These fundamentals sound basic, but they have the most significant long-term impact on your financial reputation.

Paying bills on time every month is the single most significant factor influencing your credit score. Setting up automatic payments through your bank helps eliminate human error. Next, focus on your credit utilization — how much of your available credit you’re using. Aim to stay below 30%, and ideally under 10%, for optimal scoring results. Finally, avoid making frequent credit applications, as this can trigger hard inquiries and temporarily lower your credit score.

Dow Janes highlights that credit management isn’t just about numbers — it’s about trust and opportunity. Strong credit opens doors to lower interest rates, housing approvals, and even job opportunities in some industries. Regularly reviewing your credit report also helps you catch errors or potential fraud early. When practiced consistently, credit hygiene becomes a powerful yet invisible financial safeguard.

How to Measure Progress: The Three Metrics Every Adult Should Track

Tracking progress is essential to keep financial habits on course. According to Dow Janes, what gets measured gets managed — and what gets managed improves. The three most important metrics for individuals are your savings rate, emergency coverage, and debt-to-income ratio (DTI). Together, these give a clear snapshot of financial health and show whether you’re moving closer to security or drifting away from it.

- Savings Rate: The percentage of your income you consistently set aside. Aim for at least 20%, but even 10% builds momentum.

- Emergency Coverage: The number of months your current savings could support your lifestyle if income stopped.

- Debt-to-Income Ratio: The total of your monthly debt payments divided by your gross income — keeping it under 35% indicates stability.

Create a financial dashboard using a spreadsheet or notebook. Update it monthly to track trends. Dow Janes recommends celebrating small wins, such as paying off a credit card or reaching a new savings milestone. Over time, tracking these data points not only builds awareness but also reinforces confidence — reminding you that financial progress is happening, one step at a time.

Using Trusted Tools and Resources for Ongoing Learning

Building financial literacy is a lifelong journey, not a one-time lesson. According to the OECD’s financial literacy research, adults with consistent financial education are significantly more likely to save, invest, and avoid high-interest debt. This aligns with Dow Janes’ mission to make financial education approachable and actionable for everyone, regardless of age or background.

For U.S.-based readers, the Consumer Financial Protection Bureau (CFPB) offers free, evidence-based materials, templates, and educator guides to help strengthen financial behavior. Pairing these official resources with Dow Janes’ engaging content creates a well-rounded learning experience that’s both trustworthy and easy to apply.

Financial literacy thrives when learning is an ongoing process. Regularly consuming educational videos, articles, or podcasts keeps financial concepts fresh in your mind. Dow Janes encourages a growth mindset — start small, stay consistent, and revisit lessons as your income, goals, and life circumstances evolve. When learning feels accessible and motivating, financial empowerment becomes second nature.

Conclusion

True financial literacy isn’t about chasing complex investment strategies — it’s about mastering daily money habits that build confidence and resilience. By following evidence-backed steps, such as intentional budgeting, building a steady emergency fund, and responsible credit use, you can transform your financial life one habit at a time. As Dow Janes continues to show through their empowering lessons, financial freedom isn’t about perfection — it’s about progress. Start small, stay consistent, and keep learning — because every step you take today shapes a stronger, more secure tomorrow.