Table of Contents

- Introduction to On-Demand Payment Platforms

- The Mechanics of Instant Payroll Solutions

- Benefits for Employers and Employees

- Challenges and Considerations

- Future Prospects and Innovations

Introduction to On-Demand Payment Platforms

In the hustle and bustle of today’s digital economy, the need for financial flexibility has become increasingly pronounced. This modern financial era has witnessed a pivotal evolution with the introduction of on-demand payment platforms. These digital solutions offer immediate access to earned wages, effectively changing traditional payroll processes. Instead of waiting for the typical end-of-month paychecks, employees can tap into their funds as soon as they earn them, providing a sense of financial empowerment and autonomy. In a world where financial stress is prevalent, these platforms offer a lifeline, allowing employees to navigate financial matters with newfound agility. It is wise to learn more about how these platforms are transforming the financial landscape.

The desire for immediacy in accessing funds is not merely a contemporary craving but a necessity driven by the unpredictable nature of financial obligations. The need for flexible payment structures has sharply increased, with expenses not necessarily aligning with traditional paycheck cycles. On-demand payment systems cater to this need, ensuring financial stability is within reach for a broader demographic. Whether it’s an unexpected medical bill or a sudden car repair, having access to one’s earnings at any given time provides a cushion against the financial uncertainties that life often throws our way, transforming how individuals manage their day-to-day expenses.

The Mechanics of Instant Payroll Solutions

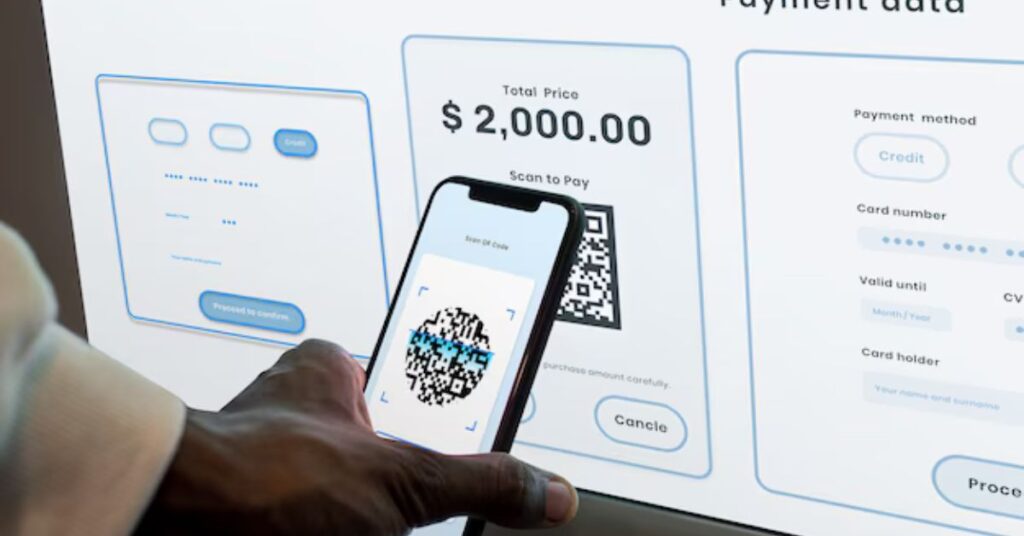

Instant payroll solutions are built on sophisticated technology aimed at facilitating rapid transactions. At the heart of these platforms is automation combined with secure transaction processing, which ensures that payments are executed efficiently and without delay. When an employee requests earned wage access, the process kicks into high gear. Systems work tirelessly in the background to verify work hours, calculate due amounts, and securely transmit funds to the recipient’s account—all within moments. The speed and accuracy provided by these systems far outpace traditional payroll methods, which often involve manual entries and lengthy processing times.

These platforms rely heavily on cloud-based infrastructures and robust encryption protocols to safeguard sensitive financial data. This automation not only speeds up the payroll process but also aims to reduce human error significantly, which is often associated with manual payroll operations. By ensuring that each transaction is accurately processed without the direct intervention of payroll staff. Companies can minimize mistakes that are typically a source of employee dissatisfaction and administrative burdens. The seamless integration with existing payroll systems makes them an attractive choice for companies wanting to modernize their financial management without overhauling existing structures.

Benefits for Employers and Employees

On-demand payment systems offer many benefits that cater to employees and employers, creating a win-win situation for all parties involved. Having instant access to wages can mean the difference between financial stability and stress for employees. This benefit is particularly significant for those living paycheck to paycheck, where an unexpected expense could lead to a financial crisis. According to a financial wellness report. Many workers face budget shortfalls before payday, and immediate access to their earned income can be a much-needed lifeline.

- Financial Stability: Immediate access to wages allows employees to handle unforeseen expenses without using costly payday loans or high-interest credit cards. This financial flexibility can significantly reduce stress and improve overall quality of life by providing peace of mind and more robust financial health.

- Improved Employee Satisfaction: With reduced financial concerns, employees often report higher job satisfaction and motivation, leading to greater productivity and lower absenteeism. Reduced financial worry allows employees to focus on their work more effectively, contributing to a more dynamic and positive workplace environment.

For employers, offering on-demand payment options can provide a competitive edge in attracting and retaining a talented workforce. By addressing employees’ financial well-being, companies can cultivate a more engaged and loyal staff,. Ultimately reducing turnover rates and minimizing recruitment and training costs. This boost in employee morale can translate to enhanced customer service and greater productivity. Providing a tangible return on investment for organizations that embrace these progressive payroll solutions.

Challenges and Considerations

While the benefits of on-demand payroll systems are substantial, their implementation is not without challenges. Security concerns are at the forefront. As these systems handle sensitive data that must be protected against cyber threats and unauthorized access. Employers must ensure that their chosen platforms comply with industry standards and regulations to safeguard employee information. Maintaining a robust security framework is crucial to protecting company and employee assets as cyber threats evolve.

Integration is another critical consideration. Businesses should evaluate how these new systems mesh with their current payroll operations, ensuring minimal disruption during the transition. Clear internal communication and training are key, enabling employees to take full advantage of the new features while understanding how to navigate potential issues. Ensuring the workforce is prepared for these new tools can smooth the transition and maximize the platforms’ potential,. Reinforcing their efficacy and relevance within the organization.

Future Prospects and Innovations

The landscape of on-demand payment platforms is dynamic, with constant technological progress paving the way for future innovations. Predictive analytics are among the exciting new features. Offering employees insights into their spending habits and helping them make informed financial decisions. Moreover, future integrations of financial wellness tools can provide personalized recommendations, helping users plan better and save more effectively. These advancements aim to empower employees with critical financial literacy and tools beyond immediate monetary transactions.