In today’s dynamic financial landscape, the concept of hard equity plays a pivotal role in shaping individuals’ and businesses’ financial security. Let’s delve into the depths of this term, understanding its essence, importance, and how it influences various sectors.

Introduction to Hard Equity

Hard equity represents tangible assets or investments that hold inherent value and can be readily converted into cash. Unlike soft equit’y , which includes intangible assets like stocks or bonds, hard equity comprises physical assets such as real estate, machinery, or business ownership stakes.

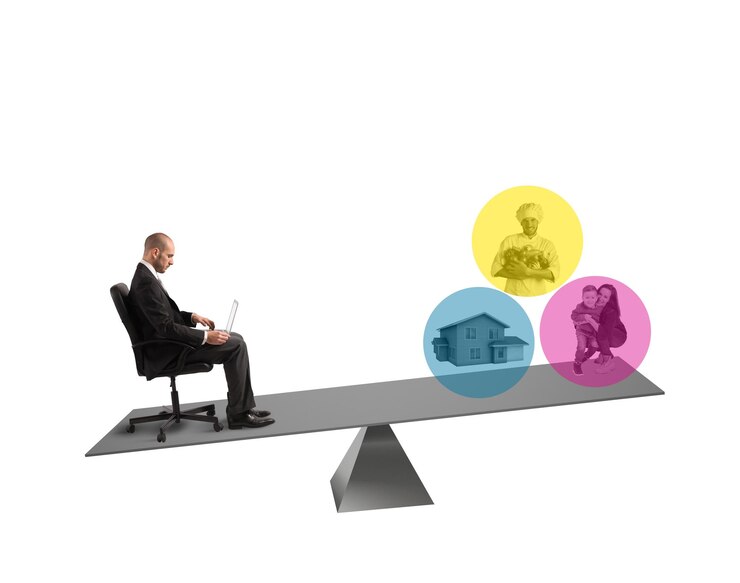

The Importance of Hard Equity

Building Blocks of Financial Stability

Hard equity serves as the cornerstone of financial stability for both individuals and organizations. By accumulating assets with intrinsic value, individuals can safeguard their wealth against economic fluctuations and unforeseen circumstances.

Role in Investment and Entrepreneurship

In the realm of investment and entrepreneurship, hard equit’y plays a fundamental role in providing capital for ventures. Whether acquiring real estate properties or investing in businesses, individuals leverage hard equit’y to generate long-term returns and foster economic growth.

Types of Hard Equity

Real Estate Equity

One of the most common forms of hard equity is real estate equity. Owning properties not only provides a sense of security but also offers opportunities for rental income and capital appreciation over time.

Business Equity

Business equit’y refers to ownership stakes in companies or entrepreneurial ventures. Accumulating shares in profitable enterprises can yield substantial returns, contributing to overall wealth accumulation.

How to Build Hard Equity

Strategies for Accumulation

Building hard equit’y requires disciplined saving and strategic investment. Individuals can start by diversifying their portfolio with assets such as real estate, precious metals, or business ventures.

Tips for Long-Term Growth

To ensure sustained growth of hard equit’y , it’s essential to adopt a long-term perspective and prioritize assets with stable value and growth potential. Additionally, prudent financial management and risk mitigation strategies are crucial for protecting hard-earned assets.

Challenges and Risks Associated with Hard Equity

Market Volatility

One of the primary challenges of hard equit’y investments is exposure to market volatility. Fluctuations in real estate values or business performance can impact the overall value of hard equity holdings.

Illiquidity

Unlike liquid assets such as stocks or bonds, hard equity investments often lack liquidity, making it challenging to convert them into cash quickly. This illiquidity factor requires careful planning and consideration, especially during financial emergencies.

Regulatory Changes

Changes in government regulations or policies can significantly affect hard equit’y investments, particularly in sectors like real estate or infrastructure development. Staying informed about regulatory developments is essential for mitigating potential risks.

Hard Equity vs. Soft Equity

Differentiating Factors

While both hard and soft equit’y contribute to overall wealth accumulation, they differ in terms of tangibility and risk exposure. Hard equity offers tangible assets with intrinsic value, whereas soft equity involves intangible investments susceptible to market fluctuations.

Case Studies: Success Stories in Hard Equity

Exploring real-life examples of individuals or businesses who have successfully accumulated hard equit’y can provide valuable insights into effective strategies and best practices for wealth building.

Future Trends in Hard Equit’y

Technological Innovations

Advancements in technology, such as blockchain and artificial intelligence, are poised to revolutionize the hard equity landscape, offering new avenues for investment and asset management.

Evolving Market Dynamics

As global markets evolve, understanding emerging trends and market dynamics becomes essential for optimizing hard equit’y investments and capitalizing on new opportunities.

Conclusion

In conclusion, hard equity serves as a bedrock for financial stability and wealth accumulation, offering tangible assets with enduring value. By understanding its significance, adopting prudent investment strategies, and navigating potential challenges, individuals and businesses can harness the power of hard equit’y to secure their financial future.

Want to hear more tips? Please look at our page for more informative and helpful blog posts.

FAQs:

What are some common misconceptions about hard equit’y ?

There are several misconceptions about hard equit’y , one being that it’s only accessible to wealthy individuals. In reality, hard equity can be built through disciplined saving and strategic investment, making it accessible to people from various financial backgrounds.

How does hard equit’y differ from traditional savings accounts or stocks?

Hard equit’y differs from traditional savings accounts or stocks in terms of tangibility and risk exposure. Savings accounts offer liquidity but generally provide lower returns, while stocks can be volatile. Hard equit’y , on the other hand, involves tangible assets with intrinsic value, offering stability and potential for long-term growth.

Are there any tax implications associated with hard equit’y investments?

Yes, there can be tax implications associated with hard equit’y investments. Depending on the type of asset and the jurisdiction, investors may incur capital gains tax or other taxes upon selling or transferring their hard equity holdings. It’s essential to consult with a tax advisor to understand the specific implications.

Can individuals with limited resources still build hard equit’y ?

Absolutely. Building hard equit’y is not solely reserved for those with significant resources. Individuals with limited resources can start by saving diligently, investing in affordable assets such as real estate through fractional ownership or crowdfunding platforms, and gradually expanding their portfolio over time.

What role does risk management play in maintaining a healthy hard equity portfolio?

Risk management is crucial for maintaining a healthy hard equity portfolio. Diversification, thorough research, and understanding the market dynamics are essential aspects of risk management. Additionally, having a contingency plan for unforeseen circumstances and periodically reviewing and adjusting the portfolio can help mitigate risks and ensure long-term stability equit’y . Risk management is crucial for maintaining a healthy hard equity portfolio. Diversification, thorough research, and understanding the market dynamics are essential aspects of risk management. Additionally, having a contingency plan for unforeseen circumstances and periodically reviewing and adjusting the portfolio can help mitigate risks and ensure long-term stability.